MARZETTI (MZTI)·Q2 2026 Earnings Summary

Marzetti Q2 FY26 Earnings: Record Gross Profit Plus $400M Bachan's Acquisition

February 3, 2026 · by Fintool AI Agent

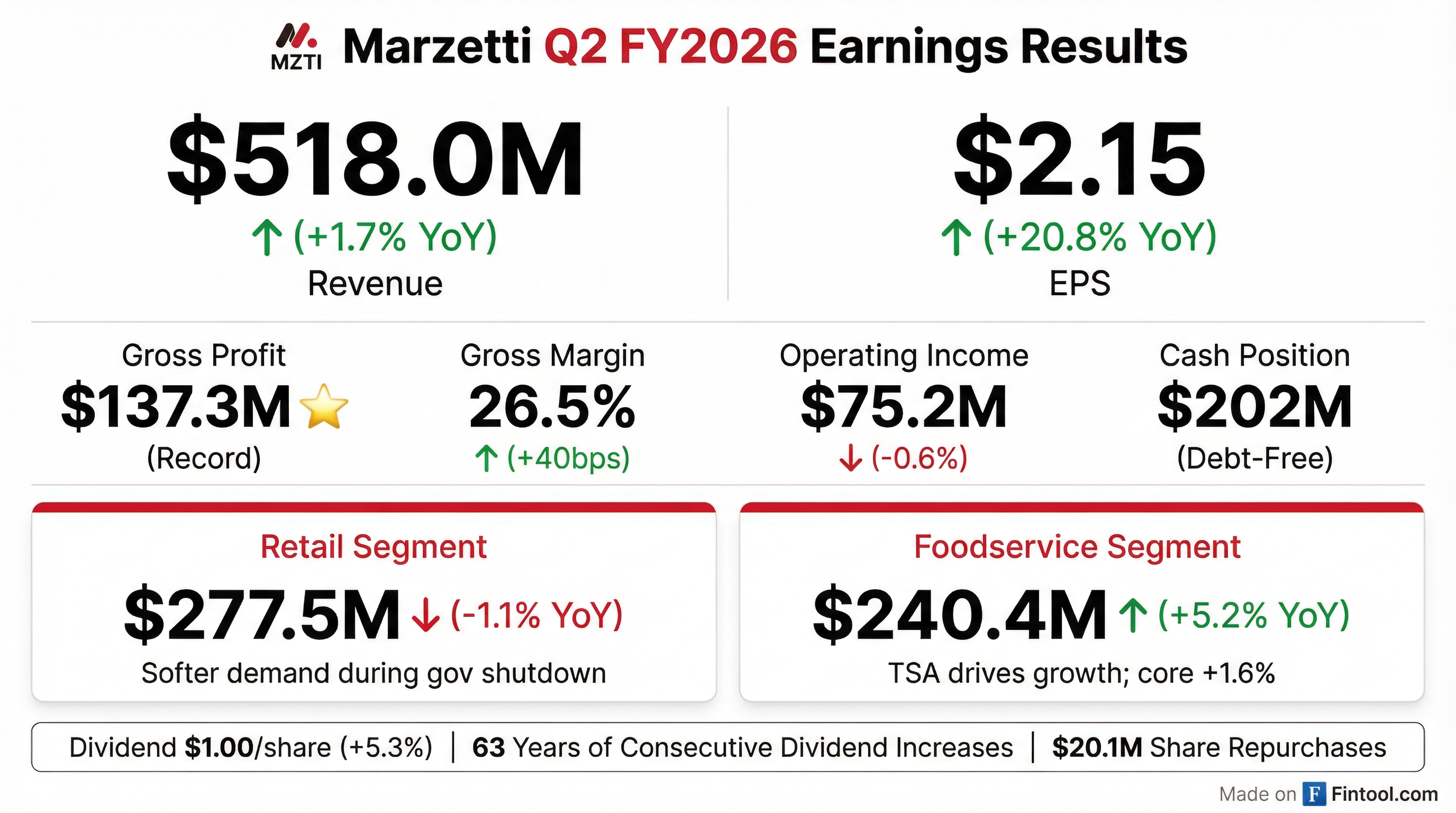

The Marzetti Company (NASDAQ: MZTI) delivered a double announcement today: fiscal Q2 2026 results with record gross profit, plus a $400 million acquisition of Bachan's, Inc., the fast-growing Japanese Barbecue Sauce brand. The earnings showed strong headline EPS growth but revealed cracks in the Retail segment, sending shares down approximately 3% in aftermarket trading.

Revenue came in at $518.0 million, up 1.7% year-over-year, though excluding $8.2 million from a temporary supply agreement (TSA) with Winland Foods, adjusted core sales were essentially flat at $509.8 million (+0.1%). Diluted EPS surged 21% to $2.15 versus $1.78 last year, but the comparison is heavily distorted by prior-year charges.

Did Marzetti Beat Earnings?

The EPS comparison requires context. In Q2 FY25, Marzetti recorded a $0.39/share noncash pension settlement charge and $0.05/share in acquisition-related costs that depressed the prior-year print. Adjusting for these items, prior-year EPS was closer to $2.22.

In the current quarter, restructuring and impairment charges (primarily manufacturing equipment impairment) reduced EPS by $0.05/share, bringing adjusted current-year EPS to approximately $2.20. On a normalized basis, core business performance was roughly flat year-over-year, with a $0.02/share decline in operating earnings.

How Did the Stock React?

MZTI closed the regular session at $173.91, up 0.7% on the day. However, aftermarket trading saw the stock fall to $168.64, a decline of approximately 3% from the close.

The muted reaction likely reflects:

- Retail segment weakness — Sales declined 1.1% with volume down 3.1%

- TSA wind-down — The $8.2M temporary supply agreement concludes in Q3 FY26, removing a growth tailwind

- Flat core earnings — Adjusted operating income actually declined $430K year-over-year

Historical earnings reactions show Marzetti typically posts positive moves on earnings days, with Q1 FY26 seeing +8.1% and Q2 FY25 up +5.8%. Today's muted regular-session gain and aftermarket decline breaks that pattern.

What Drove the Segment Results?

Retail Segment: Soft Quarter

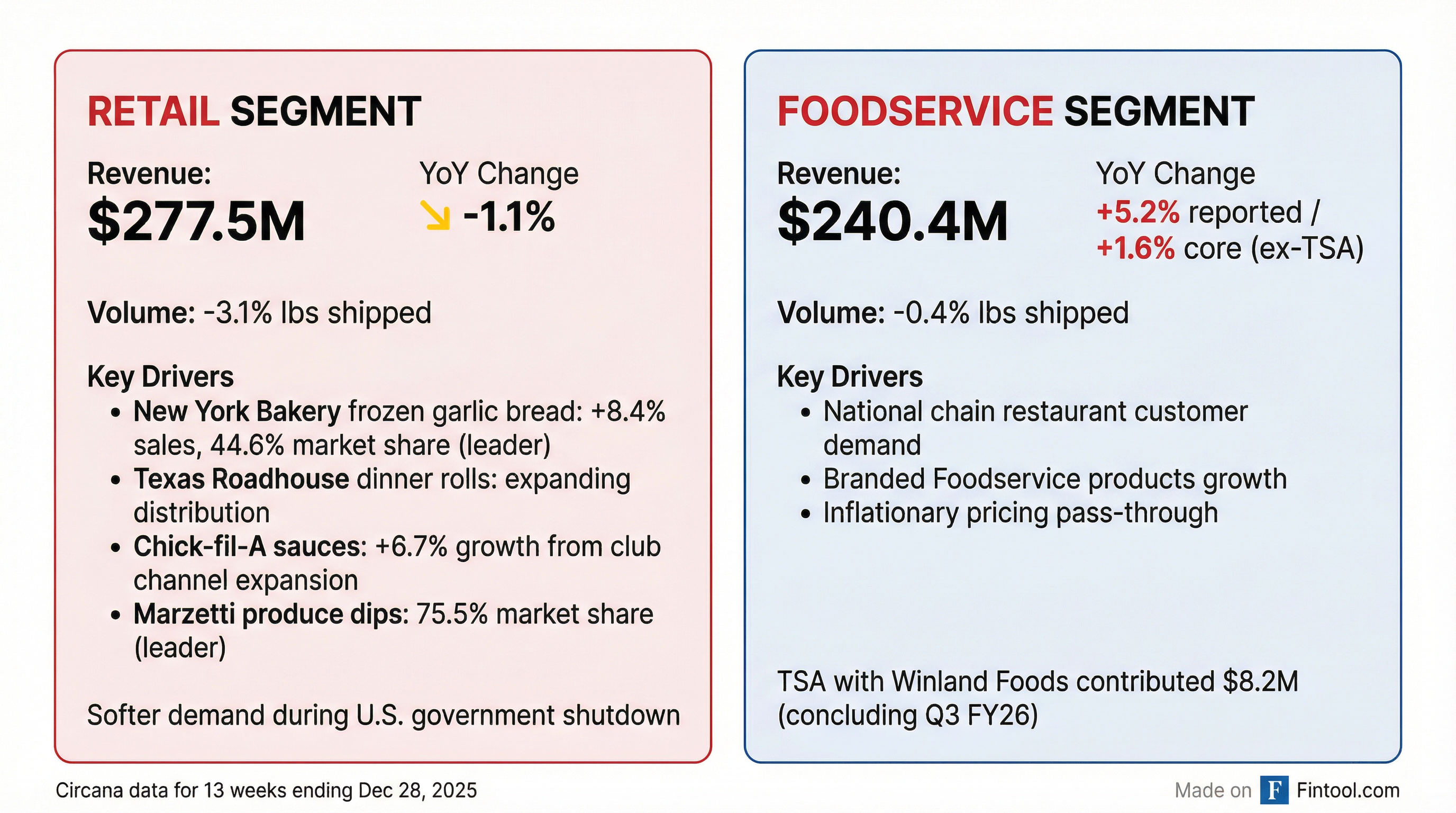

Retail net sales declined 1.1% to $277.5 million with volume (pounds shipped) down 3.1%. Management attributed the softness to weaker demand during the U.S. government shutdown timeframe, though noted this compares against a strong prior-year quarter that grew 6.3% with volume up 7.4%.

On the Q&A, CEO Ciesinski noted category slowdown was visible in the 5-week vs 13-week Circana data, but rates recovered as December progressed. Management continues to project low single-digit volume growth for retail going forward.

Brand highlights from Circana data (13 weeks ending Dec 28, 2025):

Texas Roadhouse Dinner Rolls Update:

- Exited Q2 at approximately $20 million run rate (5-week period even stronger than 13-week)

- CEO believes this could be working towards a retail $100 million run rate by fiscal year end

- Management spoke with Texas Roadhouse yesterday about partnership and "other items in the pipeline"

Foodservice Segment: TSA-Boosted Growth

Foodservice delivered $240.4 million in sales (+5.2%), though excluding the $8.2 million TSA, adjusted sales grew a more modest 1.6% while volume declined 0.4%.

Growth drivers included:

- Increased demand from national chain customers

- Branded Foodservice product gains

- Inflationary pricing pass-through

Note: The TSA commenced in March 2025 and is expected to conclude during Q3 FY26 (quarter ending March 31, 2026).

Q&A Color — More Optimistic Outlook:

CEO Ciesinski expressed the most constructive foodservice view in several quarters:

- National accounts performing well: Chick-fil-A, Domino's, Taco Bell all cited as winners

- Specialty sauce promotions supporting volume through LTOs and core menu items

- Management had guided for volume down a couple points with pricing offsetting — actual results came in "at or slightly better than expected"

Macro tailwinds for foodservice:

- Gas prices down year-over-year → discretionary spending boost for away-from-home dining

- Stronger tax refunds expected around President's Weekend

- Inflation remaining relatively in check

CEO commentary: "Short of a black swan, something changing materially on the downside... I think the setup there for all of food service is at least for a flat scenario, if not for a modest improvement."

What Did Management Guide?

Management's FY26 outlook remains consistent with prior guidance:

Three Strategic Pillars:

- Accelerate core business growth

- Simplify supply chain to reduce costs and grow margins

- Expand through focused M&A and strategic licensing

Key guidance points:

- Retail: Expected to benefit from Texas Roadhouse® dinner rolls expansion and brand innovation; earlier Easter may pull some Q3 sales forward

- Foodservice: Supported by select QSR customers; monitoring economic factors affecting demand

- Input costs: Modest inflation anticipated, offset through pricing and cost savings

- Capex: $75-85 million for FY26

Q3/Q4 Cadence (from Q&A): CFO Pigott provided modeling color: Retail expects low single-digit revenue growth for the second half, with growth fairly even by quarter. While Easter provides a Q3 tailwind, this is offset by difficult new item launch comps in the club sector. Model it "fairly even by quarter."

What Is the Bachan's Acquisition?

Alongside earnings, Marzetti announced a definitive agreement to acquire Bachan's, Inc. for $400 million, subject to customary adjustments.

About Bachan's: Founded in 2019 by Justin Gill, Bachan's was created from a multi-generational family barbecue sauce recipe passed down by his grandmother ("bachan" in Japanese). The brand is known for authentic, clean-label products made with non-GMO ingredients.

CEO David Ciesinski commented: "We are very excited to share our plans to acquire Bachan's as a strategic extension of our portfolio that will further strengthen our position in the dynamic condiment and sauce category... This transaction will reinforce Marzetti's position as a global leader in sauces by adding a premium brand that is exceptionally well aligned with evolving consumer preferences for global flavors and better-for-you products."

Strategic Rationale:

- Extends Marzetti's sauce category position

- Aligns with consumer trends toward global flavors and clean-label products

- Leverages Marzetti's retail/foodservice distribution network

- Potential for channel expansion and adjacent category growth

Transaction Advisors: Goldman Sachs & Co. LLC (financial) and King & Spalding LLP (legal) advised Marzetti. Centerview Partners LLC (financial) and Wachtell, Lipton, Rosen & Katz LLP (legal) advised Bachan's.

Bachan's Deep Dive: Q&A Highlights

Management provided extensive color on Bachan's during the earnings call Q&A:

Consumer Demographics & Brand Strength:

- Significantly over-indexes with millennials and Gen Z — key demographics for future food consumption

- Highest Net Promoter Score tested versus virtually any other brand, including popular items across sauces and other categories

- Brand has "very broad shoulders" — plays in sauces, marinades, glazes, and dips

Channel Mix & Growth:

- Grew primarily through Costco, then diversified into Walmart and traditional retail

- Mass and retail growing faster than club most recently

- International expansion potential in Canada and beyond

Margins & Operations:

- Very high-margin business with premium price point

- Immediately gross margin accretive to Marzetti's retail segment

- Currently 100% co-packed — provides pathway for manufacturing integration synergies

- Synergy opportunities in procurement, manufacturing, and distribution

Food Service Opportunity:

- Currently does very limited food service — major white space opportunity

- Potential applications: wing sauces, BBQ for national accounts, tabletop/drizzle for bowls

- Bachan's team valued Marzetti's food service reach as a selling point

Integration Approach: CEO Ciesinski emphasized a careful approach: "This is one of those scenarios where we most certainly wanna go slow to go fast. We wanna make sure we understand the business."

Three-phase growth plan:

- Refine existing distribution

- Execute new items in Bachan's and Marzetti pipelines

- Extend into broader adjacencies with new items

Capital Allocation Highlights

Marzetti continues its shareholder-friendly capital allocation:

Share Buyback Context: The $20.1M repurchase was the largest quarterly buyback in over a decade. CFO Pigott noted the company acted opportunistically given the stock had "traded off with the rest of the sector." Post-acquisition, Marzetti expects to return to its traditional (minimal) buyback approach, though dividend growth will continue consistent with history even with Bachan's leverage.

What Changed From Last Quarter?

Comparing Q2 FY26 to Q1 FY26:

The sequential improvement reflects typical seasonality (Q2 benefits from holiday demand) and continued margin improvement from cost savings programs.

Historical Financial Trends

*Values retrieved from S&P Global

The company continues to show margin improvement trajectory, with Q2 FY26 gross margin of 26.5% representing the highest level in the past two years.

Why Is Marzetti Ready for M&A Now?

When asked why this acquisition makes sense now versus years past, CEO Ciesinski outlined the infrastructure transformation that prepared Marzetti for strategic M&A:

Multi-Year Capability Build:

- Manufacturing modernization: Horse Cave expansion plus Atlanta (College Park) facility acquisition — moved from "slower, less efficient filling lines to highly efficient, scalable manufacturing"

- IT infrastructure overhaul: Replaced a 1994 Cobalt-based system with end-to-end SAP S/4HANA during COVID, all cloud-based with unified data lake

- Organic growth through licensing: Added ~$400M in profitable revenue via licensed brands (Chick-fil-A, Texas Roadhouse) while waiting for right M&A opportunity

CEO Ciesinski: "We're at a moment in time now where most of the infrastructure remediation and rebuilding is behind us, whether it's in the IT space or the physical space. It was a logical time with this experienced team to think about an acquisition."

Four Years of Tracking: Management had followed Bachan's for four years before signing the deal — literally signed the definitive agreement the night before the earnings call.

Key Risks and Concerns

- Retail segment softness — 1.1% decline despite strong licensed brands raises questions about core demand

- TSA wind-down — Loss of ~$8M/quarter tailwind starting Q4 FY26

- Bachan's integration risk — $400M acquisition at ~4.6x sales is a premium multiple; execution on distribution expansion and category growth will be critical

- Leverage increase — Marzetti will move from debt-free to taking on financing to fund the acquisition

- Consumer environment — Management flagged monitoring of U.S. economic performance and consumer behavior

Bottom Line

Marzetti delivered a mixed Q2 FY26 with record gross profit and strong year-over-year EPS growth, but the headline numbers mask essentially flat core operating performance and a rare decline in the Retail segment. The bigger story is the $400 million Bachan's acquisition — a strategic bet on premium, globally-inspired sauces that will transform Marzetti from a conservative dividend aristocrat into an active consolidator in the specialty food space.

The 4.6x sales multiple paid for Bachan's reflects the brand's rapid growth trajectory ($87M revenue) and premium positioning. While the deal will end Marzetti's debt-free status, the company's 63-year dividend growth streak and strong cash generation should support both the acquisition financing and continued shareholder returns. Key questions now center on integration execution and whether Bachan's can scale through Marzetti's distribution network as management expects.

Related: MZTI Company Profile | Q2 FY26 Earnings Slide | Q1 FY26 Earnings